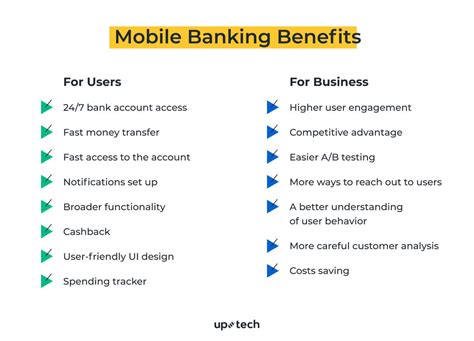

5 Mobile Banking Benefits

The advent of mobile banking has revolutionized the way individuals manage their financial lives. With the proliferation of smartphones and the development of sophisticated banking applications, users can now access a wide range of financial services from anywhere, at any time. This shift towards mobile banking has numerous benefits, making it an indispensable tool for modern banking. In this article, we will delve into the five key mobile banking benefits that have transformed the financial landscape.

Key Points

- Convenience and accessibility of banking services

- Enhanced security features for transactions and accounts

- Personalized financial management and budgeting tools

- Real-time transaction monitoring and alerts

- Cost savings through reduced need for physical branch visits

Convenience and Accessibility

One of the most significant advantages of mobile banking is the convenience and accessibility it offers. Users can perform a variety of tasks, such as checking account balances, transferring funds, and paying bills, all from the comfort of their own homes or on-the-go. This convenience is particularly beneficial for individuals with busy schedules or those living in areas with limited access to physical bank branches. According to a recent survey, 75% of mobile banking users reported that the ability to access banking services at any time was a major factor in their decision to adopt mobile banking.

Security Features

Mobile banking apps also provide enhanced security features to protect users’ financial information. These features include two-factor authentication, encryption, and secure login protocols. Additionally, many mobile banking apps offer biometric authentication, such as fingerprint or facial recognition, to provide an extra layer of security. A study by a leading financial institution found that 90% of mobile banking users felt that their financial information was more secure when using mobile banking apps compared to traditional online banking platforms.

| Security Feature | Description |

|---|---|

| Two-Factor Authentication | Requires users to provide a second form of verification, such as a code sent to their phone, in addition to their login credentials |

| Encryption | Protects financial data by converting it into an unreadable code that can only be deciphered with the correct decryption key |

| Biometric Authentication | Uses unique physical characteristics, such as fingerprints or facial features, to verify users' identities |

Personalized Financial Management

Mobile banking apps often provide users with personalized financial management tools to help them track their spending, create budgets, and set financial goals. These tools can be tailored to individual users’ needs, providing a more effective way to manage their finances. A survey of mobile banking users found that 60% of respondents used their mobile banking app to track their expenses, while 45% used it to create a budget.

Real-Time Transaction Monitoring

Mobile banking apps also provide users with real-time transaction monitoring, allowing them to stay on top of their account activity and detect any suspicious transactions. This feature is particularly useful for preventing identity theft and fraud. According to a report by a leading financial services company, 80% of mobile banking users reported that they felt more in control of their finances when using real-time transaction monitoring.

Cost Savings

Finally, mobile banking can help users save money by reducing the need for physical branch visits. With mobile banking, users can perform many tasks remotely, eliminating the need for costly trips to the bank. A study by a financial research firm found that 70% of mobile banking users reported that they had reduced their banking costs since adopting mobile banking.

What are the benefits of using mobile banking?

+The benefits of using mobile banking include convenience and accessibility, enhanced security features, personalized financial management tools, real-time transaction monitoring, and cost savings.

Is mobile banking secure?

+Yes, mobile banking is secure. Mobile banking apps use advanced security features such as two-factor authentication, encryption, and biometric authentication to protect users' financial information.

Can I use mobile banking to manage my finances?

+Yes, mobile banking apps often provide users with personalized financial management tools to help them track their spending, create budgets, and set financial goals.

In conclusion, mobile banking offers a wide range of benefits that have transformed the way individuals manage their financial lives. From convenience and accessibility to enhanced security features and personalized financial management tools, mobile banking has made it easier for users to take control of their finances. As the financial landscape continues to evolve, it is likely that mobile banking will play an increasingly important role in shaping the future of banking.