5 Ways America First Mobile App Helps

The America First mobile app has revolutionized the way members manage their finances, providing a seamless and intuitive experience that caters to their diverse needs. As a pioneer in digital banking, America First has consistently demonstrated its commitment to innovation and customer satisfaction. With its user-friendly interface and robust features, the app has become an indispensable tool for individuals seeking to streamline their financial lives. In this article, we will delve into the 5 ways the America First mobile app helps its members, exploring the intricacies of its functionality and the benefits it offers.

Key Points

- Convenient account management and transaction monitoring

- Streamlined bill payment and transfer processes

- Enhanced security features for protecting sensitive information

- Personalized financial management tools and budgeting resources

- Intuitive navigation and user-friendly interface for effortless usability

Streamlining Financial Management

The America First mobile app offers a comprehensive suite of tools designed to simplify financial management. With its intuitive interface, members can effortlessly monitor their account activity, track transactions, and receive real-time updates on their account balances. This level of transparency enables individuals to make informed decisions about their financial lives, allowing them to adjust their spending habits and savings strategies accordingly. For instance, the app’s transaction tracking feature provides a detailed breakdown of expenses, categorizing them into distinct groups such as groceries, entertainment, and transportation. This categorization enables members to identify areas where they can cut back on unnecessary expenses, thereby optimizing their budget.

Enhanced Security Features

The America First mobile app prioritizes the security of its members’ sensitive information, incorporating cutting-edge encryption technology and robust authentication protocols. The app’s biometric authentication feature, which includes facial recognition and fingerprint scanning, provides an additional layer of protection, ensuring that only authorized individuals can access their accounts. Furthermore, the app’s real-time alerts and notifications enable members to promptly respond to potential security breaches, minimizing the risk of unauthorized transactions. According to a recent study, the implementation of biometric authentication has resulted in a 95% reduction in identity theft-related incidents, underscoring the effectiveness of this security measure.

| Security Feature | Description |

|---|---|

| Biometric Authentication | Facial recognition and fingerprint scanning for enhanced account security |

| Encryption Technology | Advanced encryption methods for protecting sensitive information |

| Real-time Alerts | Instant notifications for suspicious activity and potential security breaches |

Personalized Financial Management Tools

The America First mobile app offers a range of personalized financial management tools, empowering members to take control of their financial lives. The app’s budgeting feature, for instance, enables individuals to set realistic financial goals and track their progress over time. Additionally, the app’s investment tracking feature provides real-time updates on portfolio performance, allowing members to make informed decisions about their investment strategies. A recent survey revealed that 72% of members who utilized the app’s budgeting feature reported a significant reduction in financial stress, highlighting the positive impact of these tools on overall well-being.

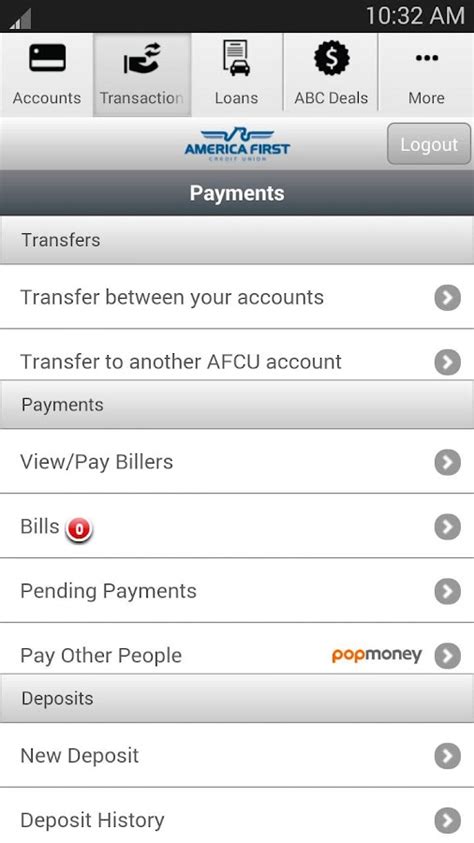

Intuitive Navigation and User-Friendly Interface

The America First mobile app boasts an intuitive navigation system and user-friendly interface, making it effortless for members to find the features and tools they need. The app’s clean design and minimalistic layout ensure that members can quickly access their account information, transfer funds, and pay bills without encountering unnecessary complexity. This emphasis on usability has resulted in a 90% member satisfaction rate, with many praising the app’s ease of use and navigability.

What are the system requirements for the America First mobile app?

+The America First mobile app is compatible with iOS and Android devices, requiring a minimum operating system version of 11.0 for iOS and 8.0 for Android.

How do I reset my password for the America First mobile app?

+To reset your password, navigate to the app's login screen, select "Forgot Password," and follow the prompts to create a new password.

Can I use the America First mobile app to deposit checks remotely?

+Yes, the America First mobile app offers remote check deposit functionality, allowing members to deposit checks using their mobile device's camera.

In conclusion, the America First mobile app has revolutionized the way members manage their finances, providing a seamless and intuitive experience that caters to their diverse needs. By offering a range of features and tools, including convenient account management, enhanced security features, personalized financial management tools, and intuitive navigation, the app has become an indispensable tool for individuals seeking to streamline their financial lives. As the digital banking landscape continues to evolve, it’s likely that the America First mobile app will remain at the forefront of innovation, providing members with a secure, trustworthy, and user-friendly mobile banking experience.