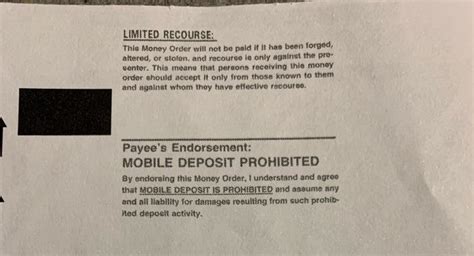

Mobile Deposit Prohibited Money Order Policy

The rise of mobile deposit technology has revolutionized the way individuals and businesses manage their finances, offering unparalleled convenience and efficiency. However, alongside this advancement, financial institutions have had to implement stringent policies to prevent fraud and ensure the security of transactions. One such policy that has garnered significant attention is the prohibition on depositing certain types of checks and money orders via mobile deposit. In this article, we will delve into the specifics of mobile deposit prohibited money order policies, exploring the reasons behind these restrictions, the types of money orders affected, and the implications for users.

Understanding Mobile Deposit and Its Risks

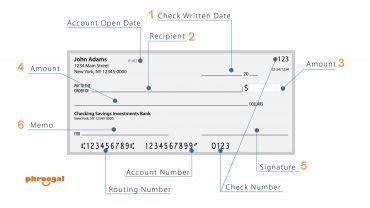

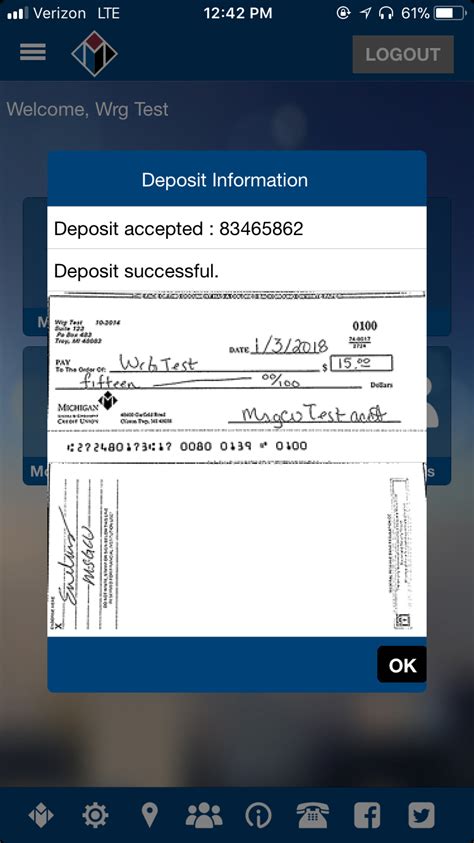

Mobile deposit allows users to deposit checks remotely using their smartphones, thereby eliminating the need to visit a physical bank branch. This convenience, however, comes with its own set of risks, particularly concerning the verification and legitimacy of the deposited items. Financial institutions face challenges in verifying the authenticity of checks and money orders deposited through mobile channels, as they cannot physically inspect these items. This vulnerability can be exploited by fraudsters, leading to significant financial losses for both the institution and the account holder.

Types of Prohibited Money Orders

Given the risks associated with mobile deposits, banks and credit unions have established policies prohibiting the deposit of certain types of money orders through mobile channels. These typically include money orders that are considered high-risk or those that have been known to be used in fraudulent activities. For instance, money orders from certain issuers with a history of fraud, or those that exceed a specific monetary threshold, might be restricted. It’s also common for institutions to prohibit the mobile deposit of money orders that are not issued by reputable or well-known entities, as these can pose a significant risk of being counterfeit.

| Type of Money Order | Reason for Prohibition |

|---|---|

| High-Risk Issuers | History of fraudulent activities associated with the issuer |

| Exceeding Monetary Thresholds | Higher value transactions are considered higher risk |

| Non-Reputable Issuers | Increased risk of counterfeit due to lack of issuer verification |

Implications for Users and Institutions

The prohibition on certain money orders via mobile deposit has significant implications for both users and financial institutions. For users, it means that they may need to visit a physical branch to deposit restricted money orders, which can be inconvenient. However, this inconvenience is a small price to pay for the enhanced security it provides. For financial institutions, implementing and enforcing these policies helps in reducing fraud losses and maintaining the trust of their customers. It also underscores the importance of ongoing customer education on the safe use of mobile deposit services.

Adapting to Mobile Deposit Policies

As mobile deposit technology continues to evolve, so too will the policies surrounding its use. Users must remain vigilant and informed about the types of money orders that are prohibited from mobile deposit. This includes staying updated on their financial institution’s policies, as these can change in response to emerging fraud trends. By working together, users and financial institutions can ensure that mobile deposit services remain a secure and convenient option for managing finances.

Key Points

- Financial institutions prohibit certain types of money orders from being deposited via mobile deposit due to fraud risks.

- Prohibited money orders often include those from high-risk issuers, exceeding certain monetary thresholds, or issued by non-reputable entities.

- These policies are designed to protect both users and institutions from potential fraud.

- Users may need to deposit restricted money orders at a physical branch, highlighting the importance of convenience versus security.

- Ongoing education and awareness are crucial for the safe and effective use of mobile deposit services.

In conclusion, while the prohibition on certain money orders via mobile deposit may seem restrictive, it is a necessary measure to combat fraud and ensure the security of financial transactions. As technology advances, it is likely that we will see further adaptations in mobile deposit policies, aimed at balancing convenience with security. By understanding and adhering to these policies, users can play a critical role in safeguarding their financial information and contributing to a more secure banking environment.

What types of money orders are typically prohibited from mobile deposit?

+Money orders from high-risk issuers, those exceeding specific monetary thresholds, and those issued by non-reputable entities are typically prohibited. The exact types can vary depending on the financial institution’s policies.

Why are these prohibitions in place?

+These prohibitions are in place to mitigate the risk of fraud associated with mobile deposits. By restricting certain types of money orders, financial institutions can reduce the risk of accepting counterfeit or fraudulent items.

What should users do if they need to deposit a prohibited money order?

+Users should visit a physical branch of their financial institution to deposit the money order. This allows the institution to verify the item more thoroughly, reducing the risk of fraud.